Beyond Equity: A Practical Guide to Employee Incentive Options for Small Businesses and Startups

Attracting and keeping great talent is one of the biggest challenges for small businesses and startups. Many employers think equity is the only meaningful incentive they can offer, but that is not the case. There are many creative, flexible, and legally sound ways to reward and motivate employees without giving away ownership. This guide walks through the most popular alternatives so you can choose the structure that best supports your business goals.

Attracting and keeping great talent is one of the biggest challenges for small businesses and startups. Many employers think equity is the only meaningful incentive they can offer, but that is not the case. There are many creative, flexible, and legally sound ways to reward and motivate employees without giving away ownership. This guide walks through the most popular alternatives so you can choose the structure that best supports your business goals.

Why Look Beyond Traditional Equity

Equity can be valuable, but it also adds complexity. Bringing employees onto the cap table may change voting rights, require updated operating agreements, affect tax status, or require outside valuations. Many founders want to reward employees but avoid dilution or long term ownership obligations. That is where alternative incentive plans shine. They can mimic the financial benefits of equity, reward performance, or share company success without giving up actual ownership.

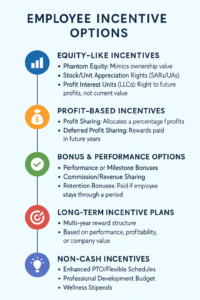

1. Equity Like Incentives Without Actual Ownership

These plans replicate the economics of equity without changing the ownership structure.

Phantom Equity

Phantom equity gives employees the financial value of equity without issuing real shares or membership units. It pays out in cash based on the company’s value at vesting, sale, or another trigger event.

Best for: Employers who want to reward long term growth without giving voting rights.

Considerations: Requires valuation and creates future cash obligations.

Stock or Unit Appreciation Rights (SARs or UARs)

These provide employees with the increase in the company’s value over time. If the company grows, employees share the upside. If not, there is no payout.

Best for: Growth-oriented roles and businesses preparing for a future sale.

Considerations: Ordinary income tax on payout.

Profit Interest Units (LLCs Only)

A profit interest gives employees rights to future profits only. They do not participate in any existing value. It can be a tax-efficient way for LLCs to reward key employees with upside potential.

Best for: Startups and LLCs with strong growth expectations.

Considerations: Requires careful structuring under IRS rules.

2. Profit Based Compensation

If your goal is to share your success without offering equity, profit-driven incentives are a strong alternative.

Profit Sharing Plans

These plans distribute a percentage of company profits to employees. You can design them to be formula based, discretionary, or distributed annually.

Best for: Teamwide motivation and alignment.

Considerations: Uses cash and may set employee expectations each year.

Deferred Profit Sharing

Instead of paying profits immediately, the company accrues rewards for payment in future years.

Best for: Long term retention and cash flow management.

Considerations: Requires compliance with deferred compensation rules.

3. Performance and Bonus Based Structures

Sometimes the simplest incentives have the most impact.

Performance or KPI Based Bonuses

Bonuses can be tied to revenue, client goals, operational improvements, or clear milestones.

Best for: Roles with measurable outcomes.

Considerations: Works best when goals are well defined.

Milestone or Project Completion Bonuses

Reward employees for hitting major deliverables. This can be used for product launches, system rollouts, major sales, or operational achievements.

Commission or Revenue Sharing

Sales roles often benefit from structured commissions or share-of-revenue models.

Best for: Growth-focused teams and business development positions.

Considerations: Must be carefully documented to avoid disputes.

Retention or Stay Bonuses

These reward employees for remaining with the company through a key period or at a transaction event.

Best for: Businesses navigating transitions or preparing for sale.

Considerations: Motivates staying but not necessarily high performance.

4. Long Term Incentive Plans (LTIPs)

LTIPs are structured plans that reward employees over multiple years based on performance, profitability, or company value.

What they may include:

Phantom equity

SARs

Multi-year cash bonuses

Profit units

Goal-driven payout schedules

Best for: Leadership teams or long range strategic roles.

Considerations: More complex to design and administer.

5. Ownership Adjacent Options

These create alignment with ownership without traditional equity grants.

Co-Investment Opportunities

Senior team members may be invited to purchase ownership at favorable terms.

Partner or Profit Share Tracks

Service based businesses can offer revenue or profit sharing without actual equity or voting rights.

6. Non Cash and Culture Based Incentives

These can be just as powerful as financial rewards.

Examples include:

Enhanced paid time off or flexible schedules

Professional development budgets

Wellness stipends

Childcare or commuting support

Remote work privileges

Project leadership opportunities

These incentives build long term loyalty and support a high trust, people-centered workplace.

Comparison at a Glance

Equity Like Incentives

Mimic ownership value

Do not dilute ownership

Moderate to high complexity

Profit Based Incentives

Align with company success

Annual cash needs

Good for team culture

Bonus and Performance Options

Simple

Flexible

Best for short and mid term motivation

Long Term Incentive Plans

Strong retention tool

Multi-year structure

Best for leadership roles

How to Choose the Right Plan

Choosing an incentive system depends on your goals, your industry, the level of the employee, and your long term plans. Here are questions to consider:

Do you want to avoid adding owners to your business

Is cash flow available for bonuses or profit sharing

Are you rewarding past results, current performance, or future growth

Do you want incentives tied to individual, team, or company performance

Do you prefer simple plans or are you open to multi-year structures

Are you planning for a sale or exit in the next several years

Final Thoughts

There is no one-size-fits-all approach to employee incentives. The best plan reflects your business goals and creates a clear, fair, and motivating reward system for your team. Non-equity options like phantom equity, profit sharing, performance bonuses, and LTIPs give small businesses the flexibility to incentivize growth without giving up ownership or control.

If you are exploring incentives for your team or want help designing a plan that fits your company, Trident Legal is here to guide you through every step. We specialize in helping small businesses build incentive structures that align with their goals, support workplace culture, and protect long term interests.

2 Hawthorne Place,

Unit 12P Boston,

MA 02114

(617)695-0009

Copyright © 2022, Trident Legal LLC, all rights reserved.