Understanding Capital Contributions and Capital Accounts

When forming a new company, owners usually make an initial capital contribution. This is simply the money or property you put into the business to get it started. It is recorded in your capital account for bookkeeping and ownership purposes, but it does not need to be kept as a separate bank balance. Many small businesses spend their initial contribution on start-up costs such as filing fees, equipment, or early operating expenses.

When forming a new company, owners usually make an initial capital contribution. This is simply the money or property you put into the business to get it started. It is recorded in your capital account for bookkeeping and ownership purposes, but it does not need to be kept as a separate bank balance. Many small businesses spend their initial contribution on start-up costs such as filing fees, equipment, or early operating expenses.

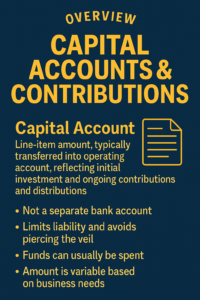

A capital account is a line item that tracks what each owner contributed and what has been allocated or distributed over time. It is not a bank account. Understanding how these accounts work helps business owners keep accurate records and maintain the limited liability protections they expect from forming an LLC or corporation.

What Is a Capital Contribution

A capital contribution is a contribution of money (cash) or property (assets) to a business in exchange for an equity ownership interest. Each owner has a capital account which tracks:

- the type of contribution such as cash or asset

- the amount or value of the contribution

- the date of the contribution

- the amount of equity or percent of ownership received

- the owner’s share of profits, losses, and distributions

Capital contributions can be made at formation as Initial Capital Contributions or later during a Capital Call. Accurate records are essential because most LLC statutes provide that a member cannot be held liable for more than the amount contributed to the company.

How Capital Accounts Work

Capital accounts function like running totals. They increase when owners contribute funds or when profits are allocated. They decrease when distributions are made or when losses are allocated.

Capital accounts increase (credited) when:

- an owner contributes cash

- an owner contributes property or equipment

- the company allocates profits to that owner

Capital accounts decrease (debited) when:

- the company allocates losses

- the owner takes a distribution of cash

- the owner withdraws property or assets

Initial Contributions and Best Practices

When you form a company, each owner makes an initial capital contribution. This amount is recorded but does not need to remain in the bank. The funds can be spent on legitimate business expenses. Many companies use the full initial contribution immediately. This does not reduce the documented contribution or change the owner’s ownership percentage. What matters is that the contribution was made and properly recorded.

Best practice after formation is to obtain an EIN and open a dedicated business operating account as soon as possible. Once the business account is open, the initial contribution should be transferred into that account for clear documentation. This creates a paper trail showing that the owner contributed funds to the company, that the company received the funds, and that the money was then used for business purposes.

Most states do not require owners to deposit the contribution into a specific bank account. However, maintaining a separate business bank account is essential for preserving limited liability and avoiding commingling of funds. Depositing the initial contribution into the business account is a strong governance practice and helps demonstrate that the business is a separate legal entity.

Why Capitalization Matters for Liability Protection

Adequate capitalization helps demonstrate that the business is a real, separate entity. Underfunding can be a factor in piercing the corporate veil, which can expose personal assets. Proper records, separate bank accounts, and appropriate insurance also support liability protection.

How Much Should You Contribute

There is no required amount for most states. Initial contributions commonly cover filing fees, early expenses, and what is needed to open business accounts. Contribute what is reasonably necessary based on your business model. Once contributed, funds can be used immediately. No minimum balance is required unless set by your operating agreement or lender.

Capital Account Summary for Startups and Small Businesses

- document your initial contribution

- record contributions and distributions accurately

- keep personal and business finances separate

- transfer the initial contribution into the business operating account after obtaining your EIN

- update your operating agreement to match contributions and ownership

- consult with professionals before making large contributions or withdrawals

If you need guidance selecting or forming an entity, obtaining your EIN, preparing an operating agreement, or navigating any part of the business formation process, Trident Legal is here to help you start strong and stay protected. Contact Us.

This content is provided for general informational and educational purposes only and does not constitute legal advice. By using this site, you understand that no attorney–client relationship is formed between you and Trident Legal LLC or its representatives. You should not rely on this information as a substitute for competent legal advice from a licensed attorney in your jurisdiction who is familiar with the facts and circumstances of your specific situation.